- ! Без рубрики

- "mostbet Sportsbook – 291

- - 382

- 1

- 10

- 10 Jili Slot 414

- 1000fikir.com

- 1000Z

- 1000Z1

- 1000Z3

- 1000Z4

- 1000Z5

- 1000Z6

- 1000Z7

- 1000Z8

- 1000Z9

- 11

- 12

- 13

- 15

- 16

- 17

- 1919womans.com

- 1win App 494

- 1win Bet 611

- 1win Bono Casino 524

- 1win Brazil

- 1win Casino 246

- 1win casino spanish

- 1win fr

- 1win Giris 143

- 1win India

- 1win Indir 481

- 1win Login 600

- 1win Login 826

- 1WIN Official In Russia

- 1win Online 611

- 1win Oyna 730

- 1win Turkiye

- 1win uzbekistan

- 1win Yukle 85

- 1winRussia

- 1winsperu.comes-pe z1

- 1xbet arabic

- 1xbet Casino AZ

- 1xbet casino BD

- 1xbet casino french

- 1xbet india

- 1xbet Korea

- 1xbet KR

- 1xbet malaysia

- 1xbet Morocco

- 1xbet Online 55

- 1xbet pt

- 1xbet russia

- 1xbet russian1

- 1xbet-apk-ph.com3

- 1xbetindonesia.site

- 1xslots-android-skachat.ru 4-8, 10

- 1xslots-bonuskod-zerkalo.ru 100

- 1xslots-bonuskod-zerkalo.ru 4-8, 10

- 1xslots-oficialniy-bonuskod.ru 10

- 1xslots-oficialniy-bonuskod.ru 4-8, 10

- 1xslots-oficialnyy-vhod.ru 4-8, 10

- 1xslots-skachat-android.ru 4-8, 10

- 1xslots-vhod-android.ru 4-8, 10

- 1xslots-vhod.ru 10

- 1xslots-zerkalo-skachat.ru 4-8, 10

- 2

- 20 Bet 702

- 20 Bet Casino 553

- 200-casino-deneme-bonus.com 1000

- 20bet App 105

- 20bet Bonus Code 148

- 20bet Bonus Code 303

- 20bet Bonus Code 768

- 20bet Bonus Code 881

- 20bet Casino 829

- 20bet Casino Logowanie 641

- 20bet Casino No Deposit Bonus 391

- 20bet Casino No Deposit Bonus 403

- 20bet Casino No Deposit Bonus Code 117

- 20bet Casino No Deposit Bonus Code 653

- 20bet Kasyno 280

- 20bet Kasyno 378

- 20bet Kasyno 772

- 20bet Kod Promocyjny 123

- 20bet Kod Promocyjny 473

- 20bet Kod Promocyjny 950

- 20bet Kod Promocyjny Bez Depozytu 777

- 20bet Kod Promocyjny Bez Depozytu 9

- 20bet Logowanie 558

- 20bet Logowanie 844

- 20bet Pl 494

- 20bet Pl 981

- 20bet Promo Code 45

- 20bet Promo Code 943

- 21

- 22bet

- 22Bet BD

- 22bet IT

- 23

- 24

- 25

- 27enerjiotomotiv.com

- 3

- 300Z

- 33level.ru

- 40-super-hot-bell-link.com

- 4000 ancorZ

- 400Z

- 431

- 4friends.ru 20

- 50 Free Spins Ggbet 546

- 637

- 668

- 7

- 7enazametku.ru

- 8

- 81

- 844

- 888starz bd

- 9

- 9-sotok.ru

- 9-sotok.rucasino 1000

- Aajogo Cassino 115

- acomics.ru

- acomics.ru10

- acomics.ru2

- acomics.ru3

- acomics.ru5

- acomics.ru6

- acomics.ru7

- acomics.ru8

- acomics.ru9

- adanaacilcilingir.com

- adanaakuyolyardim.com

- adorans.hu

- agricoyatirim.com

- agro-code.ru

- aksumyapi.com

- aktarlife.com 1000

- akupunktur-izmir.com

- Alexandercasino Bet 7

- alliance-teh.ru 50

- alpperdeyikama.com

- alte-mulistation.de

- amandaliswan.ru

- amandaliswan.rubonusi

- anadoluveterinerlik.com

- ancientmyko.net

- antalyaototamircilerodasi.com

- antsaat.com

- antsaat.com 1000

- Aplicativo Pixbet 928

- apokrifpodcast.com

- Aposta Maxima Bet 920

- App 1win 813

- App Star Casino Come Funziona 448

- aracteknik.com

- arizalamba.com

- arkadyaelektrik.com

- arsanerede.com

- artidekorasyon.net

- asosprefabrikyapi.com

- attdistant.ru 10

- au-zef.com

- auto-werkstatt-nuernberg.de

- Aviator

- Aviator 1win 471

- Aviator Aposta 667

- Aviator Bet 520

- aviator brazil

- aviator casino DE

- aviator casino fr

- aviator IN

- aviator ke

- aviator mz

- aviator ng

- Aviator Slottica Zakłady Bukmacherskie – 426

- aviator-casino-game-tr.com

- aviatrix-oyna.com

- B1 Bet 748

- b1bet BR

- b2500

- b2550

- bahis

- Baixar Aplicativo Vai De Bet 421

- Baixar App Vai De Bet 47

- Bajilive 138

- bakersvilla.in z

- bakimgunu.com

- balertoptantisort.com

- bancorallZ 1500

- Bankobet

- Basaribet

- basaribet-guncel-giris-2025.com 1000

- basaribet-guncel-giris-adresi.com 1000

- batery-app.net z3

- batikentcicekci.com 1000

- bbrbet colombia

- bbrbet mx

- Bc Crash Game 168

- Bc Game Sign In 996

- Bcasino Sign Up Bonus 761

- Bdm Bet Casino 724

- Bdm Bet Espana 773

- Bdm Bet Promo Code 537

- Bdmbet App 228

- Bdmbet Application 33

- Bdmbet Application 881

- Bdmbet Application 999

- Bdmbet Bonus 265

- Bdmbet Bonus 563

- Bdmbet Casino 381

- Bdmbet Casino 892

- Bdmbet Casino 992

- beautypalacebahcesehir.com

- bedava-50-dolar-veren-site.com

- bedava-slot-oyna.org 1000 (2)

- bedava-slot-siteleri.com

- bedava-slot.com

- belfm.ru

- benzotomotiv.com

- beregaevo.runews1021101031010 (10)

- beregaevo.runews1021101031010 (100)

- Beric Betting App 927

- berkeleysouthsidecompletestreets.org x5

- berrakartemiz.com

- Bet F12 249

- Bet On Football Mostbet Online Sporting Activities Betting – 710

- Bet365 App 409

- Bet365 App 928

- Bet365 Casino 159

- Betandreas App 976

- Betandreas Zerkalo 900

- Betano Brasil 432

- Betano Casino 805

- Betboo Guncel 800

- Betflag Accedi 394

- Betflag Casino 955

- Betnacional Oficial Entrar 348

- Betonred Bonus 315

- Betonred Login 158

- Betonred Sport 27

- Betonred Sport 419

- Betpremium Poker 170

- beyazbuket.com 1000

- bezflash.runovye-onlayn-kazino 10

- bezhinternat.ru 10

- Bgame Slot 140

- Bgame Slot 529

- bguzel.ru 20

- bh_advicepoints.com

- Big Casino 397

- Big Casino Snai App 46

- billigiptv.se

- biyskmedspo.ru

- bizzo casino

- bizzocasino.hu

- bkkirtasiye.com

- blaavand.info z2

- Blaze Aplicativo 865

- Blazer Jogos 192

- blog

- bonanza-demo-oyna.com

- Bonus Slottica Lub Spiny – 76

- bonus-veren-lisansli-siteler.com

- book of ra

- book of ra it

- bor-neked.hu1660Z

- Borrow Money On Cash App 120

- bou-sosh10.ru 10

- Brabet Download Apk Ios 797

- Brabet Jogo 558

- brainandbodyrevolution.org x

- brow-n-go.ru

- buffalo-power-megaways.com

- bulvarveteriner.com

- bursaankakooperatif.com

- bursaguvenelektrik.com

- bursaguvenelektrik.com 1000

- bursautuevi.com

- Business, Advertising

- Business, Marketing

- businessfoxesacademy.com

- butorgaleria.hu1660Z

- Buy Cbd Oil Blessedcbdcouk 119

- buy-auto-spb.ru 10

- cachecachelingerie.ru

- cachecachelingerie.rucasino 1000

- caneraker.com

- canfidancilik.com

- carpediempsikoloji.com

- casibom tr

- casino

- Casino 1win 660

- Casino Bdmbet 849

- casino en ligne fr

- Casino Energy 357

- Casino Energy 373

- Casino Energy 680

- Casino Gg Bet 838

- Casino Gratogana 572

- Casino Kingdom Login 461

- Casino Kingdom Mobile Login 929

- casino onlina ca

- casino online ar

- casinò online it

- casino utan svensk licens

- Casino Vegasino 382

- Casino Vegasino 566

- Casino Vegasino 733

- casino zonder crucks netherlands

- casino-giris-guncel-2025.com

- casino-glory india

- casino-ucak-oyunu.com

- casino-vip.cl x

- Casino770 Promotions 863

- Casinodays Login 992

- Casinomania Bonus Senza Deposito 460

- Casinomania Login 316

- casinos

- Category:Characters Fandom – 887

- catekelektrik.com

- cayyolutravel.com

- Cbd Oil For Pets 765

- cekmekoykombici.com

- celikhantutunu04.net

- cerkezkoyisilanlari.com

- Cheapest Cryptocurrency Trade Leading 12 Low Payment Alternatives – 369

- Chicken Cross The Road 413

- Chicken Cross The Road Game 813

- Chicken Gambling Game 918

- Chicken Game Money 264

- Chicken Road Crossing Game Gambling 146

- Chicken Road Es Real 887

- Chicken Road Game Gambling 786

- Chicken Road Slot 633

- chuchotezvous.ru

- cinarcikrehber.com

- cinarehliyet.com 1000

- cl.1win-chile.cldescargar-aplicacion x2

- clothgocart.com 200

- cmpmos.ru

- comodidadysalud.com.co x

- complexinvest.ru 10

- Computers, Computer Certification

- cork-24.ru 100

- Cosmo Casino Nz 446

- cospec.pk z

- cozerilaclama.com

- crazy time

- Cresus Casino En Ligne 208

- Crickex Sign Up 297

- Crypto Broker Mt5 203

- csdino

- cyprusbeautyclinic.com

- Czy Slottica Jest Bezpieczna Miejscu I Czasie – 688

- daavdeev.ru 10

- damaktakitat.com

- Darmowe Spiny Energycasino 320

- deeprockgalactic.ru 10

- dekorstil.se

- demirdokumkayseri.com

- deneme-bonusu-veren-casino.com

- denizatigrup.com

- denizlidolunayevdeneve.com

- denta-stomatologiya.ru

- dentalyildirim.com

- denvistorii.ru

- deryalifikirler.com

- devmanset.com

- dhsszerviz.hu

- dijitalemlakdergisi.com

- dileksusluer.com

- direncshop.com

- dnzhalikoltuktemizleme.com

- doubelochka.ru 10

- drerkanaksoy.com

- drguzellik.com

- ds4ess.ru

- durmusaydemir.com

- duruhobimalzemeleri.com

- dvdfutar.hu

- eceteknikservis.com

- egbs1.ru

- ekaterina-school.ru 10

- elattar.net

- elephantbet-mz.netpt-mz z

- elitlifekuaforguzellik.com

- elysiondanismanlik.com

- emkabilisim.com

- endustriyelmutfaks.com

- Energi Casino 167

- Energi Casino 916

- Energy Casino 432

- Energy Kasyno 362

- Energycasino Bonus 943

- Energycasino Bonus Bez Depozytu 210

- Energycasino Bonus Bez Depozytu 826

- Energycasino Bonus Bez Depozytu 96

- Energycasino Kod Promocyjny 258

- Energycasino Kod Promocyjny 556

- Energycasino No Deposit Bonus 243

- Energycasino Pl 299

- Energycasino Promo Code 216

- Energycasino Promo Code 411

- eryamandatesisatci.com 1000

- erzincanvizyon.com

- eskisehirdeusta.com

- Esportiva Bet App 508

- espressokft.hu

- Eurobet Bingo 406

- Eurobet Live 805

- evyap-gayrimenkul.com

- Excursions 585

- extragift.hu

- familienzentrumrubens.de

- familjehemspodden.se

- Fan Bet 140

- Fansbet Sports 687

- Fantasy Casino 11

- Fantasy Scommesse 541

- Fast Bet 840

- Fastbet It 49

- Fat Boss 967

- Fatboss Avis 212

- Fatboss Bonus 768

- Fatboss Casino 567

- Fatboss Jackpot 378

- Fatboss Play 104

- Fatboss Play 788

- Fb 777 75

- Fb 777 Casino 445

- Fb 777 Casino Login 474

- Fb 777 Casino Login 527

- Fb777 App 403

- Fb777 Casino 736

- Fb777 Live 708

- Fb777 Login 176

- Fb777 Login 229

- Fb777 Slot Casino 729

- Fb777 Slot Casino 972

- Fb777 Win 373

- Fb777 Win 573

- fcommunity.ru 1000

- feelyourbody.ru 10

- femicid.ru 200

- fidandagi.com

- fiestaklub.hu

- fikirsitesi.com

- fikirsitesi.com 1000

- Finance, Real Estate

- finansozluk.com

- fivemturkiye.net

- fixprice-katalog.ru 10

- fixprice-katalog.ru 50

- flaminguru.ru 1000

- fonduniver.ru

- fortboyard.online 20

- Fortune Gems Slot 509

- Fortune Gems Slots 650

- Fortune Gems Win 872

- Fortune Mouse Estrategia 581

- Fortune Mouse Gratis Demo 375

- fortune tiger brazil

- fortune-rabbit-demo-online.comtl (200)

- fortune-tiger-demo-online.comde

- fortune-tiger-demo-online.comes-mx

- fortune-tiger-demo-online.comvi

- fortune-tiger-demo-play.com

- fotokapan.net

- Free Fortune Gems 245

- freebet-veren-siteler.com 1000 (2)

- Fruit Party Ganhar Dinheiro 318

- Fruit Party Slot Online 529

- fuarpromotion.com

- fxforumtr.com

- Galactic Wins 804

- Galactic Wins Casino 542

- Galactic Wins Casino No Deposit Bonus 725

- Galactic Wins Free Spins 674

- Galactic Wins No Deposit Bonus 433

- Galactic Wins No Deposit Bonus Codes 255

- Galactic Wins Review 360

- Galacticwins 684

- Galacticwins 773

- Galacticwins Casino 436

- Gama Casino

- gardenstockholm.se

- gates-of-olympus-oyna-demo.com 1000 (2)

- gates-oyna-demo.com

- gaziantepklimakombiservisi.net

- gazipasataxi.com

- Ggbet Login 513

- ghsspakistan.pk z1

- glory-casinos tr

- gokgozlerdizel.com

- Gold Bet 737

- Goldbet Accedi 51

- Goldbet Casino 1

- Goldbet Poker 430

- Goldenpanda 868

- gondorkacaj.hu

- gordostnation.ru 100

- Gratogana App 278

- Gratogana Bono 628

- Gratogana Entrar 537

- Gratogana Espana 267

- Gratogana Online 173

- Gratogana Online 902

- Gratogana Opiniones 379

- Gratowin Cancellazione 503

- greekgirlscode.com

- greenkarma.de

- groznycityhotel.ru

- gucluanne.com

- Gugo Bet Login 426

- Gugobet App 427

- haboyle.com

- hakanmobilyam.com

- haliyikamamiss.com 1000

- hamelis.hu

- handaufspferd-hund.de

- hdgizlikamera.com

- hediyerehberim.com

- hello world

- Help Slot Win Jili 608

- Help Slot Win Jili 931

- hibaicmimari.com

- hindipalace.com x1

- historyrusedu.ru

- holicationvillas.com

- hostel-dachny.ru 1000

- hukukmirasim.com

- ickfa.ru 10

- igapuh.net

- igle-net.ru 100

- igle-net.ru 4-8, 10

- ihouse39.ru

- ikatrailer.com

- imageloop.ru 20

- info-posad.ru 200

- inglesina-italy.ru 100

- innovaforum.ru 150

- inouthome.hu

- Internet Business, Audio-Video Streaming

- ironshark.ru

- istekkitap.com

- isyerihemsireligi.com

- izmirbotoksdolgu.com

- Jackpot City Nz Free Spins 898

- Jackpotbob 945

- jan1

- jan4

- jan6

- jan7

- Jeetbuzz 88 132

- Jeetbuzz Download 752

- jetton-ru.ru

- Jeu Chiken 812

- Jeux Du Poulet Gratuit 781

- Jili 777 Lucky Slot 996

- Jili Slot 777 Login 342

- Jili Slot 777 Login Register Online 911

- Jili Slot 777 Login Register Philippines 808

- Jogo 7 Games 553

- jurakavefozo.hu

- kadinmodam.com

- kadinnediyo.com

- kale71.com

- kalinti.com

- karabaglarotoekspertiz.com

- karacateks.com

- karamanarackiralama.com

- KaravanBet Casino

- karavanizolasyon.com

- kartonbardakci.net

- Kasyno Online PL

- kazandiran-casino-siteleri.com

- kazino-bezdepozita.store

- kazino-bonus-registraciya.sbs

- kazino-bonus-registraciya.sbs 1000

- kedikapisi.com

- keflibicak.com

- kelebektaksi.com

- kevseriklimlendirme.com

- khelibet

- kiliclarhirdavat.com

- king johnnie

- Kiwi Casinos 506

- Kiwi Treasure Casino Nz 921

- koltuktamirhizmeti.com

- koncert-2024.ru

- konteynerimalatsatis.com

- konutkredisihesaplama.net

- koplikes.se

- korrekt29.ru 240

- korsantaksiduragi.com

- koruhastabakici.com

- kosavostra.ru 15

- kosgebkredisi.com

- kristinafrolova.ru

- Kudos App 109

- Kudos Casino 876

- Kudos Casino No Deposit Bonus 46

- Kudos Casino No Deposit Bonus 683

- Kudos Login 244

- Kudos Motorsport 772

- Kudos Motorsport 976

- Kudos No Deposit Bonus 468

- Kudos Rewards 136

- Kudos Rewards 229

- Kudos Rewards 333

- kuzeyyrentacar.com

- labdarugas.cimpa.hu

- Lampions Bet Entrar 313

- lapistaki.com

- lastikizmir.com

- le-bandit-casino.compl

- lebandit-play.com

- legendsdj.com2

- Lemon Casino 100 Free Spins 118

- Lemon Casino Bonus 546

- Lemon Casino Kod Promocyjny Bez Depozytu 2025 311

- Lemon Casino Logowanie 209

- lenasgarn.se

- lesparksad.ru 100

- libellemerkezi.com

- lifeteknoloji.com

- Linebet Login 145

- Link Vào 188bet Việt Nam An Toàn Và Không Bị Chặn – 80

- lisansli-casino-siteleri-tr.com

- local-heroes-leipzig.de

- Loft Park

- logosstudy.ru 10

- Loto Club 145

- Lotto Lottomatica 606

- Lottomatica Gratta E Vinci 550

- loviden.ru 10

- Lucky Jet 1win 240

- lunarpsikoterapi.com

- lunchval.se

- Luva Bet App Download Apk 906

- Luvabet Casino 800

- lysviksbygden.se

- madadgaar.org z2

- magistral8.ru

- magyar-online-kaszino.turania.hu

- maheshkumarandco.in x

- Major Sport Baixar Apk 960

- Maribet casino TR

- Marjo Sports 16

- Masalbet

- masalcik.com

- maslakotokurtarici.com

- masloperm.ru

- massagecenter.ru2

- masukiyeemlak.com

- Matchpoint Sisal 929

- mattanten.se

- mazzisofa.com

- mbousosh10.ru 10

- Mcw Bet Casino 41

- mcworld.mobi z4

- md-moskva.ru

- medyacoin.com

- medyumfikrethoca.com

- mega-buffalo-power.com

- Megapari Bet 566

- mehmetustasalca.com

- mehmetustasalca.com 1000

- mensa.pk x

- mersinkemankursu.com

- metinkoca.net

- mi-faq.ru

- milanotente.com

- minizookids.com

- Mission Uncrossable India 984

- mitmir90prozent.de

- modabling.com

- modaperde.net

- mohntage.com

- Monobrand

- Most Bet 100

- Mostbet App 34

- Mostbet App 505

- Mostbet Casino 283

- Mostbet Download 232

- Mostbet E Confiavel 167

- Mostbet Go Nrnb And Bog On All Cheltenham Festival Races! – 673

- mostbet hungary

- mostbet italy

- Mostbet Online 504

- Mostbet Online 847

- Mostbet Promo Code Uk 2024: Get Up To £40 In Bonuses" – 489

- Mostbet Reviews Study Customer Support Reviews Associated With Www Mostbet Com – 468

- Mostbet Russia

- Mostbet Sign Up Offer 2024 Mostbet Promo Code" – 367

- mostbet tr

- Mostbet Uz 706

- mostbet-casino-hungary.com

- mostbetapp.bet2

- mowwastore.com

- Mr Bet casino DE

- mr jack bet brazil

- museum-williams.ru

- musozensurucukursu.com

- mustafaogretmen.com

- mvclinic.ru 10

- mvclinic.ru 100

- mx-bbrbet-casino

- n1iptv.se

- nail-supermaster.ru 200

- nakliyetahtasi.com

- nartanyapi.com

- natoreplus.com x1

- netiptv.se

- Netwin Casino 358

- Netwin Casino 785

- new

- New

- New Post

- News

- newtribuna.ru

- next-season.ru 10

- nextcricketmatch.com x1

- nges.hu

- Nn777 Slot Jili 234

- noextrapoints.com z

- noktaotokiralama.com

- nongamstopcasino.eu.com

- nopril.ru

- nordiciptv4k.se

- nov1

- Novibet Aposta 282

- Nowe Kody Do Lemon Casino 645

- nuvolaconcept.com

- ogretmeniz.ne

- ogrn-inn.ru 10

- ok4poker.club

- okplaypoker.pro

- olympus-slot-demo.com

- onemlisaglik.com

- onevroze.ru

- onevroze.ru 500

- online casino au

- onlone casino ES

- opdrniyazibulbul.com

- Organic Cbd Oil 31

- organikgida.net

- ori9infarm.com

- oshle.com

- otokartal.com

- otolastikbul.com

- otosuat.com

- otzivorgt.ru 10

- ozeldus.net

- ozelsultanbeylihal.com

- ozkaracatekstil.com

- ozkardesleryapi.com

- oztatkebap.com

- ozwin au casino

- Ozwin Sign Up Bonus Banking Crypto – 200

- Pagbet Bonus 359

- Pagbet Casino 86

- para-kazandiran-slot-oyunlari.com

- para-veren-siteler.com 1000 (2)

- Party Casino 624

- Party Casino 984

- Party Casino Login 123

- Party Casino Online 939

- Partycasino App 370

- Partycasino App 430

- Partycasino Bono 470

- Partycasino Opiniones 288

- pastissersgirona.com

- pb_jaspersboardinganddoggiedaycare.com

- Pdc World Darts Championship Odds, Picks: Betting Breakdown For Day 1 – 750

- pelican casino PL

- pendik9noluasm.com

- pestmegyeiapro.hu

- pienarhabercilik.com

- pienarhabercilik.com 1000

- Pin UP

- Pin Up Betting 75

- Pin Up Brazil

- Pin Up Casino 370

- Pin UP Online Casino

- pinco

- piriltiorganizasyon.com

- Pixbet Palpite 19

- plastikfabrikasi.net

- Play Croco 386

- Play Croco Casino Australia 41

- Play Croco Casino Australia 727

- Playcroco App 134

- Playcroco Casino 230

- Playcroco Casino 756

- Playcroco Online Casino 406

- plinko

- plinko in

- plinko UK

- plinko_pl

- pluskoltukyikama.com

- poderygloria.net

- Pokerstars Casino Login 605

- pokk.hu

- prefabrikevadana.com

- Premier Athletics Betting And On Line Casino Platform In India – 613

- prestijdil.com

- profizyonel.com

- projectinblue.com 1000

- pryazhaschool.ru 10

- ptsmup.ru

- Public

- Publication

- pucenkoclinic.ru 10

- pulmix.ru 10

- Qizilbilet

- Queen 777 130

- Queen 777 Casino Login Register 425

- Queen 777 Casino Login Register 677

- Queen777 App 200

- Queen777 Casino Login 525

- Queen777 Register Login 73

- r7-kazino-zerkalo.ru 36

- r7-zerkalo-casino.ru

- r7casino-otzivy.ru

- radyohalk.com 1000

- rainerholbe.de

- rairorestaurant.com.pk z

- Ramenbet

- rcdimos.ru

- rcdimos.ru2

- Real Bet Login 857

- recepty-multivarki.ru

- renkderyasi.com

- resatillkaribien.se

- resto-elephant.com

- Review

- reviewer

- rezume2016.ru 4-8

- ricardoveron-afrodizyakparfumu.com

- ricky casino australia

- risetechsol.com

- risetechsol.com 1000

- romadondurma.net

- roof-trade.ru 36

- roof-trade.ru 4-8

- rosomed2020.ru 10

- rostinternet.ru

- Royal Vegas Mobile Login Nz 678

- Royal Win Apk 49

- Royal Win Game 25

- Royalwin App 973

- rtp-si-yuksek-slotlar.com 1000 (2)

- ru-npf.ru 10

- ruoivolga.ru 10

- rupinterestcompin2

- rupinterestcompin3

- rupinterestcompin5

- rupinterestcompin7

- rupinterestcompin8

- ruskonsoloslugu.com

- russcult.ru

- ruyaevi.net

- ruzgarexpresskurye.com

- saglam-casino-siteleri.com

- samara-sts.ru 200

- samogon-gonim.ruall

- samolet-ekaterinburg.ru

- samsunservisi.com

- sanatvebilgi.com

- sanayiailesi.net

- sapthagiricollegeofphysiotheraphy.com z3

- saray-ruyasi-oyna.com

- saray-ruyasi-slot.com

- Satbet Login 581

- sch2kr.ru 10

- school-64.ru 240

- se

- seirlertoplusu.com

- sekercisinankayaoglu.com

- Self Improvement, Happiness

- selsapizza.com

- selust.com

- selust.com 1000

- sepyou.com

- serfix.net

- sertkarsogutma.com

- servishizmetisorgula.com

- servisimkocaeli.com

- servismerkezi-tr.com

- shandinhillsgolf.com2

- shopblackberry.ru 10

- shopblackberry.ru 100

- sinanspor.com

- sint-market.com

- sintai1010.ru 100

- siriusdogal.com

- Sisal Poker 286

- sistemarabuluculuk.com

- sistersbeautyclub.com

- Site De Apostas Online 265

- siyezburada.com

- Sky247 Live Login 809

- Skycity 583

- slot

- Slot Jackpot Monitor Jili 541

- Slots

- Slots`

- slottica

- Slottica 16 European Roulette – 163

- Slottica 50 Free Spins Mais Populares Entre – 241

- Slottica 50 Free Spins No Deposit 842

- Slottica 656

- Slottica 930

- Slottica Abzocke Best Casino Online Nj – 579

- Slottica Apk Wady Kasyna – 649

- Slottica Bez Depozytu Live Casino Roulette Malaysia – 978

- Slottica Casino 762

- Slottica Casino 97

- Slottica Casino Opinie 207

- Slottica Casino Opinie 795

- Slottica Casino Opinie Ekspertów I Graczy – 444

- Slottica Casino: 50 Free Spins Live Casino Bonus 200 – 372

- Slottica Download Dla Nowych Jak – 598

- Slottica Erfahrungen Best Casino Online Review – 321

- Slottica Güvenilir Mi Best Live Online Casino Uk – 730

- Slottica Jak Usunac Konto 286

- Slottica Jak Wyplacic Pieniadze 590

- Slottica Jak Wyplacic Pieniadze 729

- Slottica Kasyno 528

- Slottica Kasyno Bonus Bez Depozytu 136

- Slottica Kontakt 580

- Slottica Pl 278

- Slottica Şikayet Live Casino – 652

- smartiptvnordicviking.se

- smartline93.ru 240

- smartnordiciptvviking.se

- soliqvahayot.uz

- solvinto.ink

- sonmezlersile.com

- spacesports.ru 20

- Spin Casino Free Spins No Deposit 162

- Spin Casino Mobile Login 965

- Spinbet Promo Code 616

- Spinz Casino No Deposit Bonus 797

- Sportaza Non Paga 82

- Sportsbet Online 83

- standwithukrainetour.com 20

- standwithukrainetour.com 200

- startupsupercup.com z1

- studyandplay.ru

- sugar rush

- sugar-rush-megaways.com

- survivorallstar2022.com

- suticiyorum.com

- svensk-iptv.se

- svenskaspelregler.se

- svenskslang.se

- sweet bonanza

- sweet bonanza TR

- sweet-bonanza-1000-turkiye.com

- sweetroseandwren.com x1

- t.mebonus_pokerdom

- t.mecasino_1xBet_official_ru

- t.meofficial_site_pokerdom

- t.mepokerdom_oficial 2

- t.mepokerdom_otzyvy

- t.mepokerdom_vhod

- t.mepoker_pokerdom

- t.meriobetcasino_official 2

- t.meriobet_promocod 2

- t.meriobet_zerkalo_na_segodnya 2

- t.meselector_casino_zerkalo

- t.meselector_official_ru 2

- Tala 888 Casino Login 601

- Tala888 Legit 47

- Tala888 Login 282

- tanismanticaret.com

- taskestiasm.com

- tcmk24.ru

- tcmk24.ru 2000

- tecrubekonusuyor.net

- tehnoing.ru 100

- tehnoing.ru 4-8, 10

- tekirdagkombiservisi.com

- teknik1servis.com

- teknolojidevi.net

- telefonekran.com

- tenisz-palya.hu

- terapilink.com

- teresalopez.se

- termizsh.uz

- thepokiespeople.com z10

- thepokiespeople.com z9

- tiempoendublin.com z4

- Tigre Sortudo Plataforma 702

- timasderi.com

- tinyhousetatil.com

- tmeBezDep1000Zanosy

- tmeBezDepBonusss2026

- tmeBonusRegRealMoney

- tmeHaiGHRollerEMpire2026

- tmeKaSSiNoFriSpinyHyPe2026

- tmeKazinoFrispinyHype2026

- tmeMegaMinDepSlots

- tmeMgnovennyVyvod2026

- tmempokerdom

- tmeRealMoneyAvtomaty

- tmeRuletkaNaDeneg2026

- tmesmpokerdom

- tmespokerdomofitsialniisaitigrat

- tmespokerdomofitsialniisaitzerkal

- tmespokerdomskachatandroid2026

- tmespokerdomzerkalorabocheenaseg

- tmespokerdomzerkalosaita

- tmespokerdomzerkaloskachat

- tomoylomoburgers.cl x1

- toylarahsap.com

- triartarenda.ru 1000

- tufekcioglugeridonusum.com

- tunaanaokulu.com

- tutbonus.ru

- tuzergayrimenkul.net

- tuzergayrimenkul.net 1000

- tuzlaklima.net

- ufmsra.ru 20

- ufmsra.ru 200

- ugraloppet.ru

- uhm.hu

- unalsomuncuoglu.net

- unluckywind.net x1

- urunfotografim.com

- urunfotografim.com 1000

- uzmandiyetisyenkonya.com

- Vaidabet 327

- valleyventana.org

- Vegas11 Join 174

- veltramo.xyz

- verde casino hungary

- verde casino poland

- verde casino romania

- verin-tennis.rubezdepozitnyy-bonus-kazino 10

- verin-tennis.rubezdepozitnyy-bonus-kazino 20, 30

- vestum.ru

- vetcentrnn.ru

- vicivedi.com

- viktvaktarnasmatkasse.se

- villadizayn.com

- villaparkgelibolu.com

- vitrinle.com 1000

- Vivabet Casino 746

- vodka-casino-oficialnyy-sayt.ru 10

- volisyonpsikoloji.com

- volleyball-news.ru

- voltranprinter.com

- Vovan Casino

- Vulkan Vegas Casino 605

- Vulkan Vegas Kasyno 109

- Vulkan Vegas Kasyno 997

- Vulkan Vegas Login 395

- Wanabet App 835

- Wanabet App 941

- Wanabet Bono Bienvenida 761

- Wanabet Bono Bienvenida 870

- Wanabet Casino 276

- Wanabet Casino 404

- Wanabet Casino 997

- Wanabet Promociones 341

- Wanabet Promociones 646

- Wild Sultan Casino Avis 93

- Wildz Casino Nz 536

- Wildz Casino Review 406

- wings-apart.ru

- Winspark Login 5

- winterengel.com3

- winterfisher.ru

- world-vision.ru

- www.ablakuvegmester.hu

- www.abszolutbalansz.hu

- www.allfy.hu

- www.assarto.de

- www.badacsony200.hu

- www.bikerpeters.de

- www.blizeyewear.se

- www.camping-adventure.eu

- www.capitaleuropeiadomovel.com z2

- www.casino-faktura.net

- www.dachnoe3.ru

- www.didactisvt.com x1

- www.dorfkrug-boberg.de

- www.edenivegan.hu

- www.erlebniswelt-krauschwitz.de

- www.ertekesitoallas.hu

- www.esb-netzwerk.de

- www.fiestasdefabula.com.ar z2

- www.fn92shop.com x2

- www.fn92shop.com x3

- www.frickskonditori.se

- www.gfds-inc.com z2

- www.heelow.se

- www.highdesertkeepers.org x10

- www.hotel-net.hu

- www.hultinssonsbygg.se

- www.infinplan.ru

- www.kaiferos.eu x2

- www.lafacturaelectronica.es x2

- www.lafacturaelectronica.escasinos-sin-deposito-minimo x3

- www.lakas1x1.hu

- www.mappingbd.org x1

- www.marher.eu x1

- www.medbebis.se

- www.medizinrecht-ratgeber.de

- www.naehschule-hamburg.de

- www.nlife.se

- www.oxygeneassistanat.com x1

- www.oxywell-tec.de

- www.peterstridh.se

- www.piccolatoscanapecs.hu

- www.radiocarnivalbd.com x3

- www.restauraceart.cz z

- www.selbsthilfeverband-inkontinenz.org

- www.szegedbolcsode.eu

- www.technosport.hu

- www.thesocialhub.pk x2

- www.ticketleap.eventsticketsangolanews

- www.ticketleap.eventsticketsyedoverahogyan-mukodik-az-ingyen-porgetes-befizetes-nelkul-az-online-kaszinokban

- www.ticketleap.eventsticketsyedoveraingyen-porgetes-befizetes-nelkul-hol-erheto-el-valodi-ajanlat

- www.ticketleap.eventsticketsyedoverauj-online-casino-mire-figyelj-az-elso-regisztracio-elott

- www.tubakkesztyu.hu

- www.turania.hu

- www.vergaberecht-ratgeber.de

- www.visitsmolensk.ru

- www.wekerlekos.hu

- www.willwax.ru 2

- wwwticketleapeventsticketsangolanewsbefizetesnelkulibonusz2026jatsszkockazatnelkul

- xn—-10sbn10aphbddbl0a.xn--p1ai 10

- xn—-htbdjdogytnf3i.xn--p1ai

- xn--1010-6kcyk1d2d.xn--p1ai 10

- xn--1010-6kcyk1d2d.xn--p1ai 100

- xn--90afbbc8aejlj1a2jfyv.xn--p1ai 100

- xn--en-kazanl-slot-oyunlar-66b19ona.ne

- xn--g1aedcobac6ae.xn--p1ai

- xn--para-kazandiran-ans-oyunlar-nce63k.net

- yaylaasefcobanasm.com 1000

- yeni-cikan-casino-siteleri.com

- yeni-slot-siteleri.com

- yesilmutabakathaber.com

- ymdgraphic.com

- yoreselcepte.com

- yurtdisiegitimofisi.com

- zants.ru 100

- Zet Casino Canada 388

- Zet Casino Login 69

- Zet Casino Online 19

- Zet Casino Online 376

- Zet Casino Review 997

- Zet Casino Withdrawal 253

- zmirotocekicisi.com

- zonguldakbasket67.com

- авиабаза101.рф 10

- забава Авиатор В Казино Олимп – 70

- Комета Казино

- Новая папка

- Новая папка (2)

- Новая папка (3)

- Новая папка (4)

- Новая папка (5)

- Новая папка (6)

- Новая папка (7)

- фгос-игра.рф

- Швеция

- mostbet Wagering On The App Store" – 862

- 产品资讯

- 冠军心路

- 售前赛

- 未分类

- 赛事消息

- 预选赛

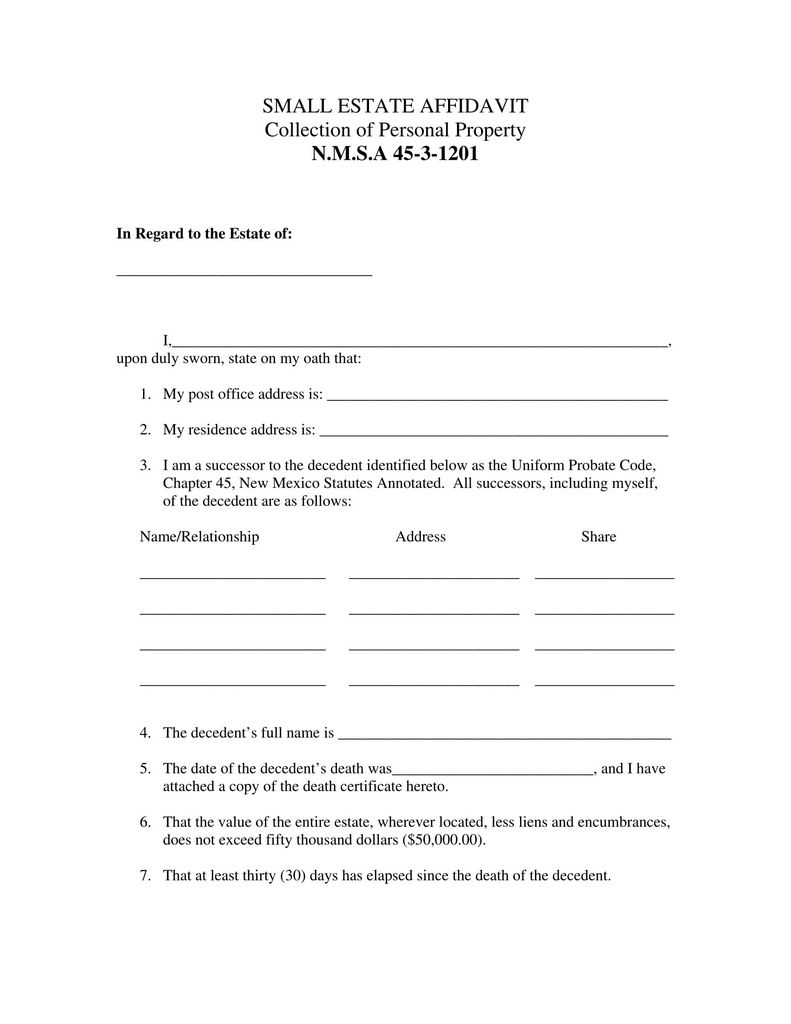

Transfer of Small property without inheritance registration

2025年12月31日 by editor

Probate in Arizona is much simpler and less expensive than in many various other states. While many states have adopted the Uniform Inheritance Code and removed inheritance and inheritance tax, about 20 states still charge heirs a cost for the advantage of acquiring also small amounts of residential property. Arizona has no inheritance or estate tax.

Determining whether an inheritance is transferable utilizing an affidavit

What is ‘estate property’? Estate residential or commercial property is personal effects that the deceased possessed only in his/her name. A stock, car, or interest-bearing account that only bears the deceased’s name on the act is estate residential or commercial property. Savings account that are vessel (pay after fatality) accounts; joint savings, examining, or investment accounts are exempt to probate. Vehicles with a 2nd individual on the title action or a beneficiary designation; and life insurance plans with a named recipient are also not subject to probate.Читать utah affidavit of small estate comprehensive guide Для того, чтобы сайт None of these joint or probate properties are consisted of in the estimation of the estate’s size. If you build up all probate assets and the total is $75,000 or less, Arizona law enables beneficiaries to utilize a basic and cost-effective procedure to administer the estate. It is called ‘Affidavit of Foreclosure of All Personal Property.’

Procedure for certifying inheritance for Small property using a testimony

The process for filing a sworn statement is clearly laid out in the laws. ARS §& sect; 14-3971 states that an affidavit can not be made use of till at the very least thirty day have passed considering that the fatality. Added demands for using the testimony process are that no personal rep (executor) has actually been selected by the court and the value of the personal property does not go beyond $75,000. Personal effects is essentially anything that is unreal estate. This treatment can also be used if additional personal property of as much as $75,000 is found after the closure of standard probate proceedings. In this latter instance, the law calls for that the individual agent be rejected and the probate process have actually been closed for more than a year.

Claimants to the estate complete a form called an ‘Affidavit of Collection of All Personal Effects.’ You can find this form in the self-help section of the Superior Court internet site. You look for www.azcourts.gov, click on Superior Court, after that click the area where you live. Go to the self-help section of the Superior Court web site for the region and find the probate forms and guidelines. Complete the Testimony and authorize it before a notary or the region staff. Then take the signed and notarized Testimony to a financial institution, the deceased company (if there is a wage financial obligations), or one more institution that holds the deceased’s personal property. Some banks might require that the Sworn statement be certified by the court. In this case, you will certainly need to go to the clerk of court, pay a cost, currently $27.00, and have your affidavit accredited. You might additionally require a duplicate of the fatality certificate when you submit your affidavit. You may send out copies of the affidavit and death certificate to non-local agencies. The affidavit will likewise permit the DMV to alter the title of any type of vehicle owned by the deceased to show the modification in ownership.

The affidavit needs to clarify your partnership to the dead and why you are qualified to the personal effects. It asks whether the deceased had a will and whether you are named in it.

As we age, we require to meticulously take into consideration just how we desire our accounts to be dealt with after we die. Including member of the family to the ownership of your vehicle or your savings account is a huge threat. As soon as you possess these accounts collectively with an additional individual, the co-owner has equal rights to the car or money in the account. Think about joint accounts only if you are absolutely certain that you can rely on the various other person to watch out for your best interests. There have actually been way too many cases where a child or brother or sister has taken all the cash, leaving the original account proprietor with zero equilibrium. That’s not a risk you want to take. A much safer alternative is to make your bank accounts husk accounts. CAPSULE (payable on death) accounts cost nothing to set up; there are no limits on the amount the account can hold; and the beneficiary has no right to the cash while you are alive. The only disadvantage is that you can not mark an alternating beneficiary.

Automobiles can be handled in much the same means, utilizing a recipient classification to transfer the lorry after fatality. You can download and install a simple type from the Arizona Division of Electric motor Vehicles web site. You simply fill out the form, have your trademark notarized, and offer the kind to the MVD, attached to the car’s present certificate of title. The MVD will certainly after that release a brand-new certification of title with the recipient classification. A recipient designation is a far more safe and secure way to move possession after your death than joint possession.

Testimony of transfer of possession of real estate

There is also a form for the Affidavit of Transfer of Title to Real Property, however this is somewhat more challenging. It can be filed by a spouse, minor kid, or adult beneficiary. The Affidavit of Transfer of Title can not be filed with the court until at the very least 6 months after the death. The individual or individuals signing the Sworn statement needs to license that the court has not appointed an individual rep or that the probate proceedings were shut greater than a year earlier and the personal representative has actually been discharged. The signatures must certify that the worth of the residential property is $100,000 or much less besides liens and encumbrances are released. They must accredit that no one besides the signatures has any kind of rights to the residential property and that no tax obligations are due. The Testimony permits the signatures to assert support instead of propertystead ($18,000), inheritance tax exemption ($7,000), and family assistance. As soon as finished, the Sworn statement needs to be filed with the court, along with the original title web page of the Probate Application and the original will (if any kind of). More comprehensive info on this process can be discovered in the instructions uploaded on the High Court Self-Help Centre.